Portfolio Management

Our Portfolio Management service acts as your trusted gatekeeper, guiding you through the complexities of global financial markets with clarity and confidence. We serve as your strategic partner, ensuring that every investment decision is aligned with your long-term goals and risk tolerance.

Our approach is built around delivering a total solution—from strategy design to execution and ongoing oversight.

BEYOND ASSETS. TOWARD IMPACT.

Customized Investment Planning

INVESTING BUILT AROUND YOU

Every investor is unique—and so should be their investment strategy

Our Customized Investment Mandates are tailored to reflect your personal or institutional objectives - whether your focus is on growth, income generation, or capital preservation.

We specialize in designing structured solutions that seamlessly integrate:

Defined

Investment

Objectives

Clear, measurable targets aligned with your financial goals and investment horizon.

Risk

Management

Customized risk profiles to match your comfort level and strategic intent.

Asset Class Preferences

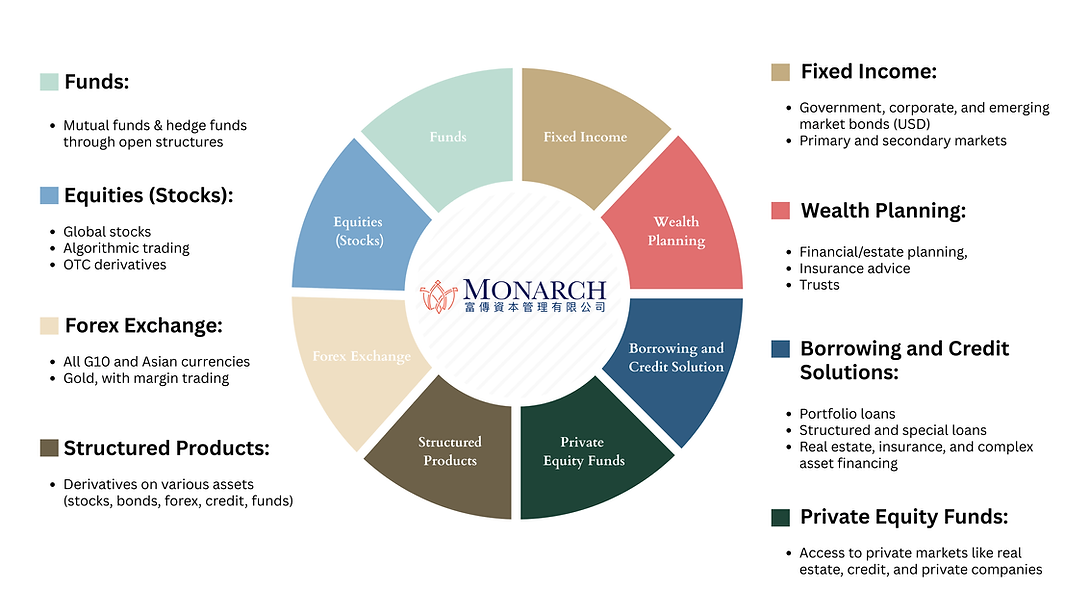

Tailored allocations across equities, fixed income, alternatives, and structured products based on your investment philosophy.

Liquidity

Needs

Thoughtful balance between long-term growth and short-term accessibility to meet your cash flow requirements.

Each mandate is a bespoke framework, crafted through close dialogue with you and implemented seamlessly via our network of trusted banking and brokerage partners.

We build portfolios that perform today - and evolve for tomorrow.

A Collaborative Framework for Investment Excellence

EMPOWERING YOUR PORTFOLIO WITH GLOBAL PERSPECTIVE

As an External Asset Manager (EAM), we collaborate with a wide range of reputable financial institutions.

Through their platforms, our clients can open and maintain custody accounts, allowing them to safeguard their assets directly with these institutions.

We establish independent agreements with each financial institution, while our clients authorize us to manage their assets held across these platforms. Depending on their needs, clients may choose to open accounts with multiple institutions.

Acting as their trusted gatekeeper, we provide centralized oversight and active portfolio management, enhancing flexibility, transparency, and control for our clients.